how are rsus taxed in california

Total number of RSUs. How are rsus taxed in california Friday March 4 2022 Edit.

Grant date and vesting commencement date.

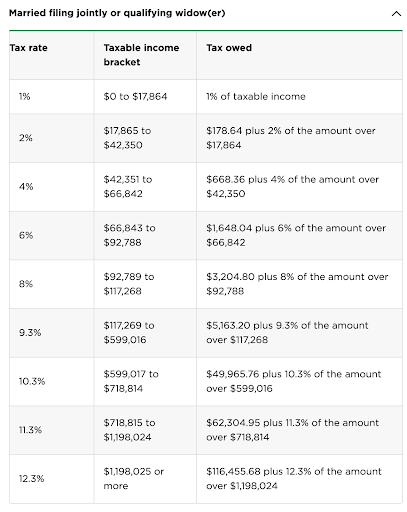

. Typically the way these things work is that you can take a tax credit on your resident state income tax return for taxes paid to a non-resident state in the situation where the income is reported on both state income tax returns. The total amount of RSUs will show up as a component of your total wages on your W2. The value of over 1 million will be taxed at 37.

Home are california rsus wallpaper. RSUs are treated as supplemental income. This doesnt include state income Social Security or Medicare tax withholding.

Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. RSU Tax Rate. Because there is no actual stock issued at grant no Section 83b election is.

How are trusts taxed in California. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. Once you know your Allocation Ratio multiply your total RSU income from the 612020 vest date by your Allocation Ratio.

In states like California where there is a state tax on earned income part of the shares is sold for federal withholdings and part is sold as state withholdings The total amount of RSUs will show up as a. Since the RSUs are on top of salary and bonus they would tend to hit in the 24 32 35 37 tax brackets. Taxation of RSUs.

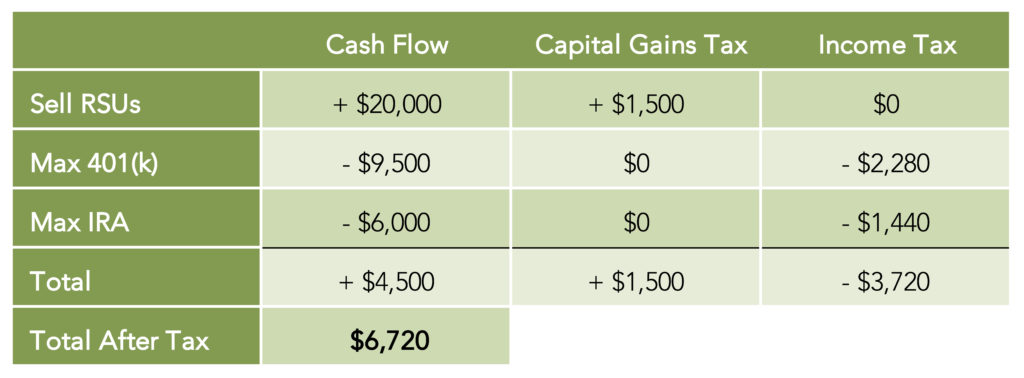

If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future. When you receive RSUs you can approximate the value of the grant by multiplying the number of RSUs and the closing stock price on the date of grant.

Assuming a 35 Federal tax rate means your total tax bill on these shares is 17500. With RSUs you are taxed when the shares are delivered which is almost always at vesting. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

The Ultimate Guide To Getting Divorced In California Survive Divorce The World S 100 Trillion Question Why Is Inflation So Low Trillion The 100 Big Picture. That income is subject to mandatory supplemental wage withholding. Value of the unvested RSUs before taxes.

You may wonder why is this W2 income and not showing up as a capital gainsloss item. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. For people working in California the total tax withholding on your RSUs are actually around 40.

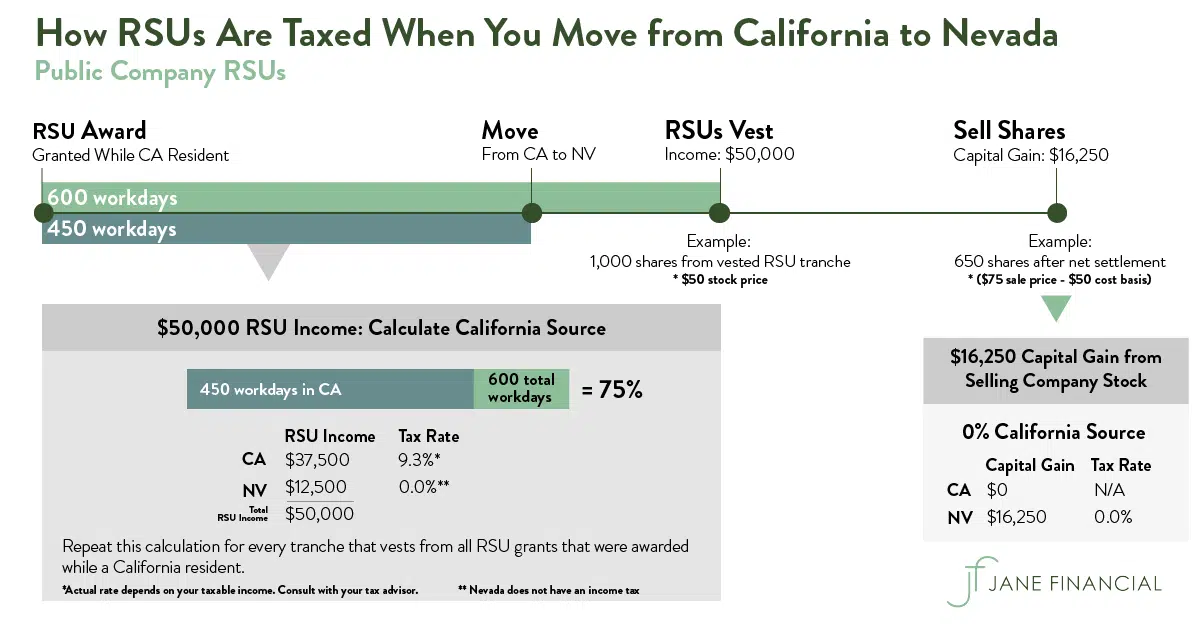

California workdays from purchase date to vesting date Total workdays from purchase date to vesting date Income taxable by California Total income from restricted stock allocation ratio. Youll have to calculate the percentage of time from the grant date to the exercise that you spent working in California and then the percentage of that income will be taxed in California. So for example if you are single any taxable income you make from 164926 to 209425 is taxed in the 32 bracket and 209426 to 523600 would be the 35 bracket over 523601 in 37.

CA Taxable Income Total RSU income from vest x Allocation Ratio And keep in mind that when your shares vest in 2021 and. G enerally a trust is subject to tax in California if the fiduciary or beneficiary other than a beneficiary whose interest in such trust is contingent is a resident regardless of the residence of the settlor See Cal. For people working in California the total tax withholding on your RSUs are actually around 40.

There were 365 days from grant to exercise and you worked 50 of those days 182 in the state of California. Stock price on 122019. At vesting date California taxes the portion of the income from RSUs that corresponds to the amount of time you lived in California between the grant date and vesting date.

You have compensation income subject to federal and employment tax Social Security and Medicare and any state and local tax. Then if the shares are held for a year and then sold for 8 0 per share you will pay taxes on a. The beauty of RSUs is in the simplicity of the way they get taxed.

For example if you lived in California for two of the three years of a three-year vesting period on your RSUs then two-thirds of the income from RSU vesting will be California incomeeven. In states like California where there is a state tax on earned income part of the shares is sold for federal withholdings and part is sold as state withholdings. In some states such as California the total tax withholding on your RSU is around 40.

Most companies will withhold federal income taxes at a flat rate of 22. Unlike the much more complicated ESPP they get taxed the same way as your income. The 22 doesnt include state income Social Security and Medicare tax withholding.

The allocation ratio is. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. How are RSUs taxed in the state of California.

Theyre taxed as ordinary income - so its based on your marginal tax bracket. If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k. Your taxable income is the market value of the shares at vesting.

How much will my RSUs be taxed. Can a state you no longer reside in collect taxes when an RSU vests in later years. At any rate RSUs are seen as supplemental income.

The taxation of RSUs is a bit simpler than for standard restricted stock plans. The 22 doesnt include state income Social Security and Medicare tax withholding. You owe taxes on 5 0000 of RSU income for 202 1.

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units Jane Financial

California Income Tax And Residency Part 2 Equity Compensation And Remote Work Parkworth Wealth Management

Rsu Tax How Are Restricted Stock Units Taxed In 2022

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

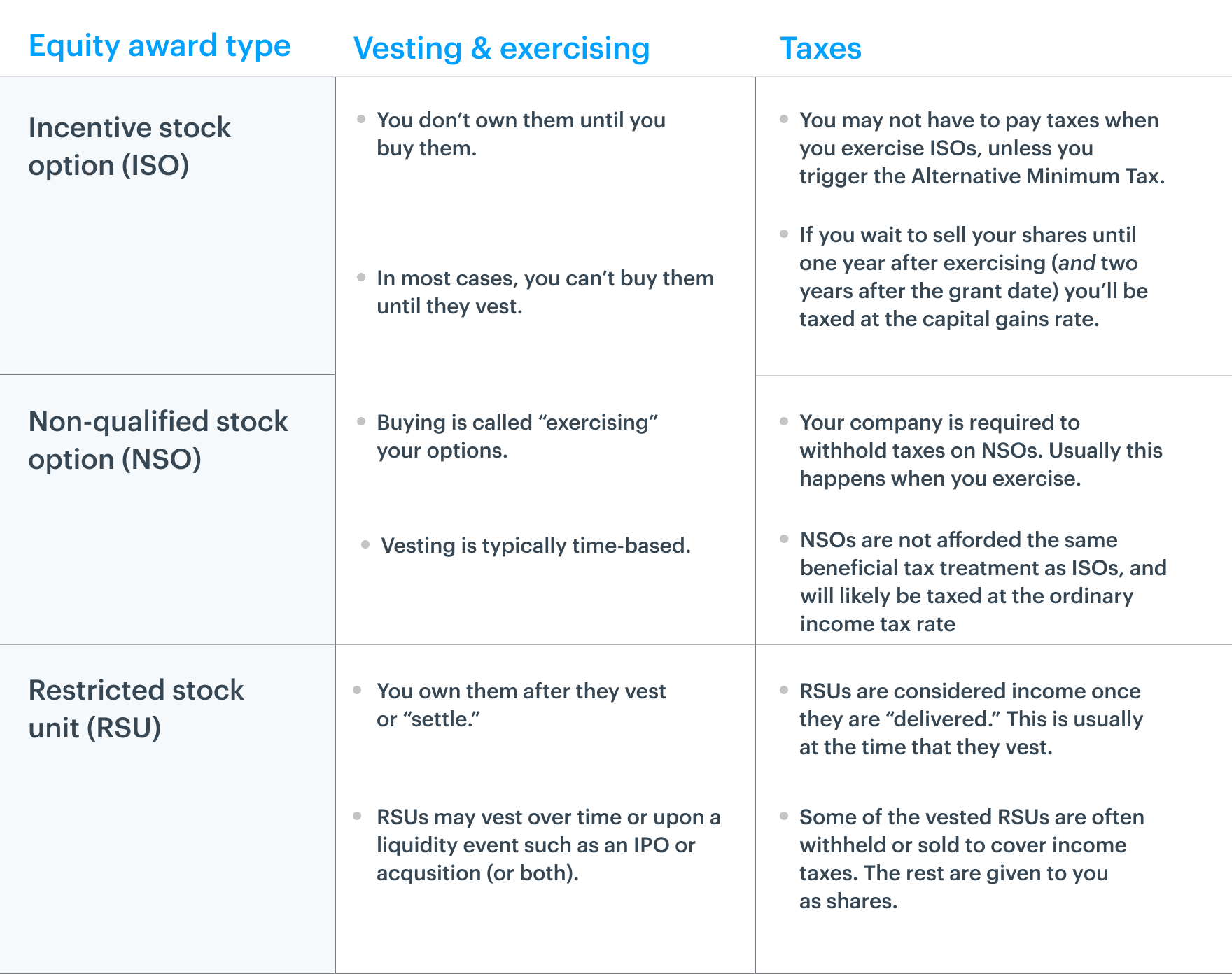

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

A Guide To Restricted Stock Units Rsus And Divorce

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial