last day to pay mississippi state taxes

Saying Mississippi is unable to follow the Federal July 15 income tax extension due to the 550000000 impact it would have on the state budget the Mississippi Department. Q2 Apr - Jun July 20.

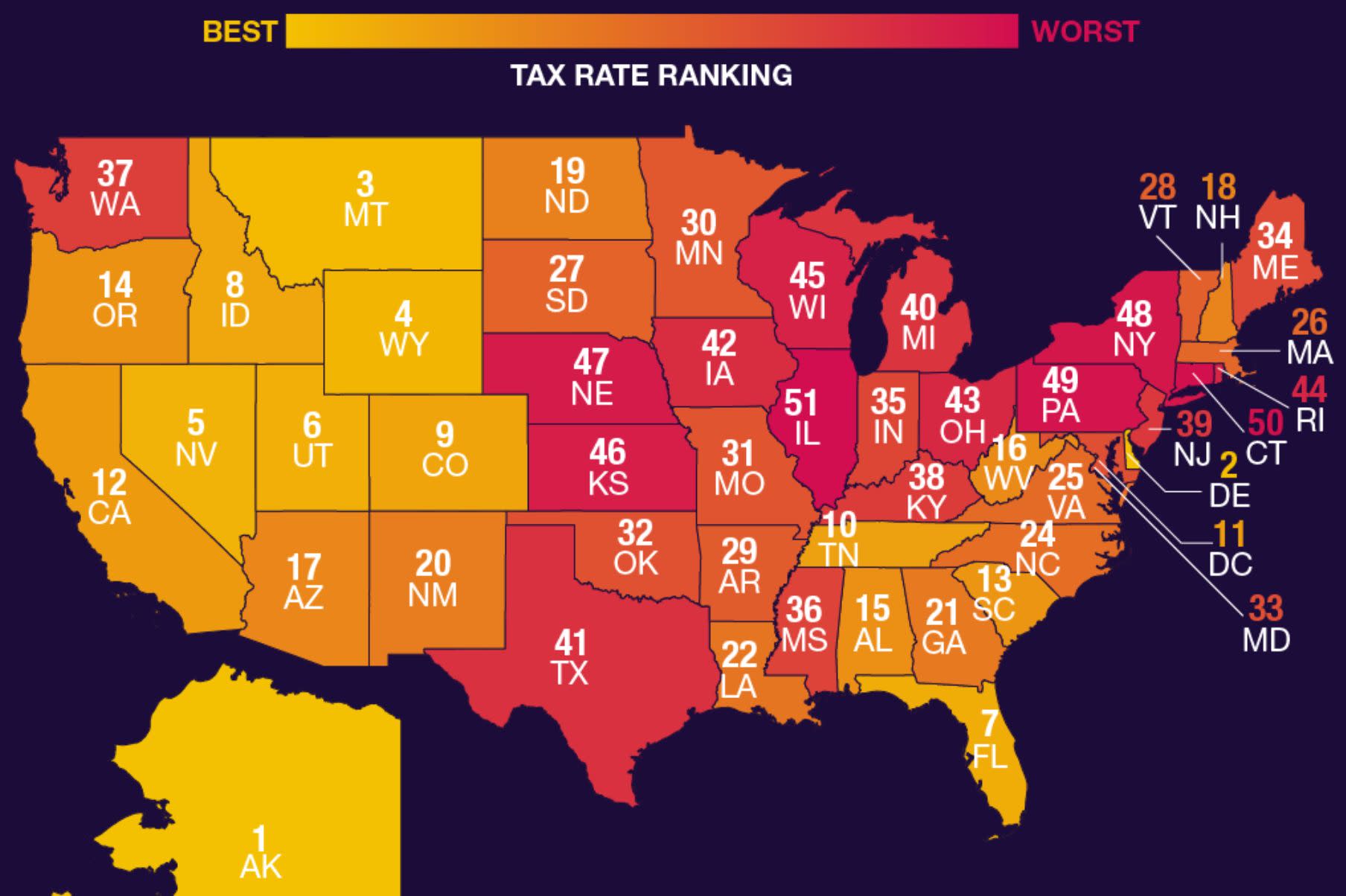

The Best And Worst U S States For Taxpayers

Ad valorem taxes are payable on or before February 1.

. Tax amount varies by county. The time frame can vary based on the method of filing - paper vs electronic. Income tax returns must be postmarked on or before the 2022 filing due date to avoid penalties and late fees.

The new due date for filing income tax returns is July 15 2020. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Additionally you may check your state refund status by using the link below.

Mississippi state taxes are due annually on April 15 Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. 2nd Quarter Due July 31st. Figure out your filing status.

WLBT - Mississippi Department of Revenue announced an extension to tax filing. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or eCheck. The due date is April 182022.

Quarterly wage reports and taxes are due by the last day of the month following the close of each calendar quarter. A handful of states have a later due date April 30 2022 for example. The federal government moved the date from April 15 to July 15 last week.

WCBI If youre a property owner in Mississippi its time to pay up. Independent Contractors are Not Employees. Reduce state income tax revenue by 525 million a year starting in 2026.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. Why didnt you mail me an income tax form. March 24 2020.

When Are Taxes Due. Mississippi residents will be required to file their state income tax before the Federal tax filing deadline. The legislation contains language that the plan will be examined by 2026 with an eye toward personal income tax elimination.

1st Quarter Due April 30th. This website provides information about the various taxes administered access to online filing and forms. You will need to attach a copy of your federal extension federal Form 4868 with your Mississippi income tax return when you file.

Calculating your Mississippi state income tax is similar to the steps we listed on our Federal paycheck calculator. 052 of home value. An extension of time to file does not extend the time to pay any tax due.

Most state income tax returns are due on that same day. To avoid interest and penalty charges you should pay your tax by the April 15th due date. 3rd Quarter Due October 31st.

Mass Mailing of Income Forms Discontinued. Outlines this information and more regarding state refunds when to expect them and what you can do if you believe that. The quarterly due dates are listed below.

The Senate voted 39-10 to pass the measure on Sunday with five Democrats joining the Republican majority in favor. So the tax year 2021 will start from July 01 2020 to June 30 2021. The extension applies to individual income tax returns corporate income and franchise tax returns and fiduciary income tax returns.

How do I report Gambling Winnings. Counties in Mississippi collect an average of 052 of a propertys assesed fair market value as property tax per year. Late payment penalty and interest apply to any unpaid tax after April 15.

If the due date falls on a weekend or state holiday the filing due date is the next business working day. The deadline now matches up with the federal tax day which. Please take a look at the article below that.

In March the state moved the deadline to file and pay 2019 individual income tax to May 15 2020. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. The interest rate is 1 per month and the penalty rate is ½ of 1 5 per month or part of a month from April 15 until the date the final payment is received.

Where do I mail my return. Apt Suite etc City. This article is only concerned with employees not independent contractors.

Mississippi tax year starts from July 01 the year before to June 30 the current year. Check the Status of your Individual Inco me Tax Refund What is the due date. Like the Federal Income Tax Mississippis income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

First quarter 2020 Mississippi estimated tax payments were also extended to May 15. Late payment penalty will accrue to a maximum of 25. The median property tax in Mississippi is 50800 per year for a home worth the median value of 9800000.

Review You must. Property tax deadline passed in Mississippi August 23 2018 WINSTON COUNTY Miss. All information returns are due by the last day of March.

Q1 Jan - Mar April 20. Why did you send me a 1099-G. Up to 25 cash back W-2s filed on paper are due by the last day of February.

The due date for filing a MS tax return and submitting MS payments is April 18 2022. Federal income taxes for tax year 2021 are due April 18 2022. The DOR provides to the tax assessor uniform assessment schedules for motor vehicle and mobile homes.

The House passed the measure 92-23. Find IRS or Federal Tax Return deadline details. All ad valorem taxes are collected by the local county andor municipal tax collectors.

Effective Jul-01-2022 The sales tax on wholesale purchases and wholesale sales of alcoholic beverages.

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 Retirement Retirement Income Best Places To Retire

Most State Taxes Due April 17 Too Map Us Map Usa Map

Taxation Of Social Security Benefits By State Social Security Benefits Map Social Security

Your Tax Bill 107 Days Of Work To Pay Off Interesting Information Freedom Day Thoughts

Which Are The Most Tax Friendly States For Retirees 2020 Newretirement

State Corporate Income Tax Rates And Brackets Tax Foundation

States With Highest And Lowest Sales Tax Rates

States With No Income Tax H R Block

Which Are The Most Tax Friendly States For Retirees 2020 Newretirement

How Do State And Local Individual Income Taxes Work Tax Policy Center

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Do I Have To File State Taxes H R Block

The Most And Least Tax Friendly Us States

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice